Mike Palmer

Managing Principal

Ark Royal Management

3700 National Drive, Ste. 218

Raleigh NC 27612

919-710-8655

Wouldn’t most of us like to lose a few extra pounds or commit to a daily fitness routine? The challenge comes in actually doing what is required to achieve those goals. We start eating healthy, but can’t resist a late night bowl of ice cream or slice of pie. Or we start walking each day, but let rainy days interrupt our routine. Most folks are well intentioned, but have difficulty maintaining discipline. Sadly, the same is often true with managing one’s personal finances.

As Warren Buffett says, successful investing is simple but never easy. Investors too often allow emotion (greed, fear, overconfidence) to drive behavior, and the result is typically inferior performance. The annual DALBAR investor survey is a great example of how well-intentioned misbehavior hampers investment results.

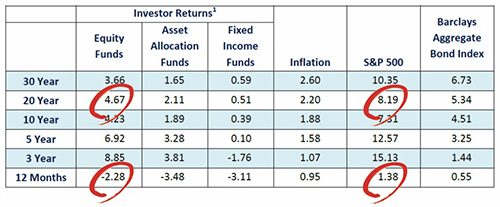

The chart below shows the difference between the S&P 500 index return and actual equity investor returns. As of the end of 2015, investor behavior (moving in and out of the market and making poorly timed manager changes) resulted in 3.5% less return annualized over 20 years. Assuming the investor started with a $1 million investment portfolio that would equate to a $2.4 million difference! (Source: Dalbar)

And thus far this year, the trend of investors as a whole doing the wrong thing at the wrong time is continuing. According to the Investment Company Institute, investors have collectively withdrawn about $70 billion from equity mutual funds through July 30. During the same period, the S&P 500 is up about 5%.

So how can investors improve their discipline? Resist the urge to chase the latest investment fad. Have a well-devised plan and stick with it. Or consider hiring a capable, experienced financial advisor that can help bring discipline to your investment strategy. The result is you’ll be more likely to enjoy a successful investment experience and a secure, independent retirement.

1. Returns are for the period ending December 31, 2015. Average equity investor, average bond investor and average asset allocation investor performance results are calculated using data supplied by the Investment Company Institute. Investor returns are represented by the change in total mutual fund assets after excluding sales, redemptions and exchanges. This method of calculation captures realized and unrealized capital gains, dividends, interest, trading costs, sales charges, fees, expenses and any other costs. After calculating investor returns in dollar terms, two percentages are calculated for the period examined: Total investor return rate and annualized investor return rate. Total return rate is determined by calculating the investor return dollars as a percentage of the net of the sales, redemptions and exchanges for each period.

Source: Dalbar